Bowes and Associates are trusted tax experts in Georgia. We specialize in IRS resolution, back taxes, wage garnishment relief, tax filing, and planning. Our expert team provides personalized solutions to resolve your tax challenges and secure your financial future. From unfiled returns to IRS problems, we've got you covered. Contact us today for expert guidance and peace of mind in all your tax matters.

TurboTax Entire Provider - Types-Centered Pricing: “Starting at” pricing represents the base selling price for one federal return (incorporates a single W-two and a person Kind 1040). Final price may fluctuate determined by your precise tax scenario and sorts utilised or bundled with all your return. Price tag estimates are supplied before a tax specialist beginning Focus on your taxes. Estimates are depending on First information and facts you give regarding your tax circumstance, which include kinds you add to aid your pro in making ready your tax return and varieties or schedules we predict You'll have to file depending on Everything you inform us about your tax predicament.

The above article is meant to provide generalized money details made to teach a wide section of the public; it doesn't give customized tax, financial investment, lawful, or other business enterprise and professional assistance.

Enrolled brokers – Certified with the IRS. Enrolled agents are subject to the suitability check and should move a three-part Exclusive Enrollment Examination, that's a comprehensive Examination that requires them to show proficiency in federal tax planning, particular person and business tax return preparation, and illustration.

Watch taxpayer returns and produce state studies for e-file participant info with condition TDS and EFIN extract.

"I'd problems around a possible tax issue and planned to talk to a specialist. Mr. Klasing was pretty knowledgeable and handy, and cleared up my concerns for the duration of our consultation.

PTIN holders – Tax return preparers who've an Energetic preparer tax identification quantity, but no professional credentials and do not participate in the Once-a-year Submitting Year System, are authorized to get ready tax returns.

TurboTax Stay - Tax Information and Professional Overview: Usage of a specialist for tax concerns and Expert Overview (the opportunity to Possess a tax expert assessment) is bundled with TurboTax Reside Assisted or being an update from One more TurboTax merchandise, and offered by way of December 31, 2025. Access to an authority for tax inquiries is likewise provided with TurboTax Dwell Full Service and available by way of December 31, 2025. If you employ TurboTax Are living, Intuit will assign you a tax pro determined by availability. Tax specialist availability may be minimal. Some tax subjects or cases is probably not provided as element of this service, which shall tax attorney Atlanta be identified with the tax pro's sole discretion. A chance to retain the same pro preparer in subsequent a long time are going to be depending on an expert’s alternative to continue employment with Intuit as well as their availability within the moments you decide to arrange your return(s).

Shoppers may help us by becoming particular when asking concerns. The more details We have now, the a lot quicker we may help.

You will talk to the auditor and provide the asked for documents in the mail, over the cellphone, or electronically. A tax law firm will help you prepare the documents and handle any discrepancies the IRS could locate.

A preparer tax identification selection (PTIN). Any person who prepares tax returns in Trade for compensation need to have a preparer tax identification quantity within the IRS. The preparer have to signal your tax return and supply a PTIN.

Although there aren't any bank loan expenses linked to the Refund Progress bank loan, separate charges could implement if you end up picking to purchase TurboTax with all your federal refund. Shelling out together with your federal refund just isn't necessary for that Refund Advance mortgage. Added expenses might submit an application for other services that you choose.

Professionals go to the trouble to pay attention and recognize your latest condition and aims (together with any fast tax reduction you might require to halt or prevent a wage garnishment, lien, or financial institution levy).

E-Companies is a set of web-based mostly resources for tax professionals, reporting agents, mortgage loan lenders and payers to transact Using the IRS. To accessibility accounts, you will need to settle for the conditions of settlement any time you sign up.

Since his assistance like a senior trial attorney within the IRS, Brandon has fought not easy to protect, and acquire profitable outcomes for, his purchasers, which include:

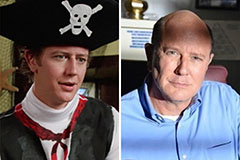

Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!